Real Estate Agents Wear Many Hats

Real estate agents must work with a great many varied issues to help keep escrows intact. Agents who are most effective in this role are those who have developed a long-term perspective and are able to assist the various parties involved to also take a long-term view of situations and problems.

The skills agents must have to really accomplish this consistently and successfully include being clear and honest thinkers, resourceful problem solvers, emotional buffers, and supportive therapists. Communication skills required include being detailed, focused on all issues, patient, and keeping a healthy sense of humor.

Closing Is the Goal

Any experienced agent knows that marketing or locating properties is probably less than 25 percent of the work. The majority of efforts during the transaction is making sure it closes, and the agent is responsible for coordinating a complex series of events in order to succeed.

This involves working with many service providers: escrow officers, title company people, pest control inspectors, retrofitters, building inspectors, supplemental inspectors of sewer lines or chimneys, and so forth. Of course, the agent also handles federal, state, county, and city disclosures, plus many other required documents. There are more than 30 pages of contract and disclosure forms.

Incorrect or inept handling of any aspect of the transaction can cost the client tens of thousands of dollars in the negotiation process, or far worse, in any later court action.

Agents who use detailed checklists of all the steps required to close the escrow are best able to prevent problems or to assist more effectively in resolving any that arise.

Unexpected Things Happen in Escrow

Here are some examples of the variety of issues I have seen come up unexpectedly in escrow:

- Non-disclosed, non-permitted additions to a home.

- Boundary lines not being where the seller claimed (it is far too easy to assume that a fence or wall is on the property line).

- Seller’s decision to remove window treatments or chandeliers without previous disclosure.

- Buyer’s expectation that certain items would be included with the property (one escrow nearly fell apart over an English dartboard!).

- Seller “forgot” to mention periodic underground water below the house.

- Seller’s insurance claims a few years ago for water damage (such as from an overflowing toilet) is revealed.

- Seller not disclosing that they knew someone died in the home (as required by law).

- Seller camouflaged musty smell with candles and air fresheners and buyers subsequently discovered mold.

- Seller not mentioning that the house next door is soon-to-be a new home construction site.

- The buyer begins to notice the outdated appliances and fixtures.

- Seller reacts defensively to some opinions of the buyer’s inspector.

- The buyer becomes aware that street or park lights shine in the windows.

- Seller reacts negatively to requests for supplemental inspections of roof or sewer line and denies access.

- Buyer’s resentment after seller’s denial of access to the property during requested times.

- Buyer or seller reactions to incomplete or inaccurately communicated information by one of the agents.

- An unanticipated situation where the seller discovers they need several weeks more time before they move and the buyer is not willing to agree to the change in schedule.

- The inaccurate assumption by the buyer that termite work is seller’s responsibility or that seller MUST correct defects, alter unsafe conditions, replace missing or broken fixtures, etc.

- Seller is unwilling to allow any access for family members, friends or decorators to view the property.

- Buyer expecting ready access for several hours at a time with advance notice.

- Agent does not explain the existence and potential significance of CC&R’s, which may prevent an addition to the house that buyer intended.

- Discovery that a deceased spouse is still on title.

- A change of marital status during escrow which can create title transfer problems.

- Buyer’s children fight over who gets which bedroom.

- Well-meaning relatives cannot believe the price tag.

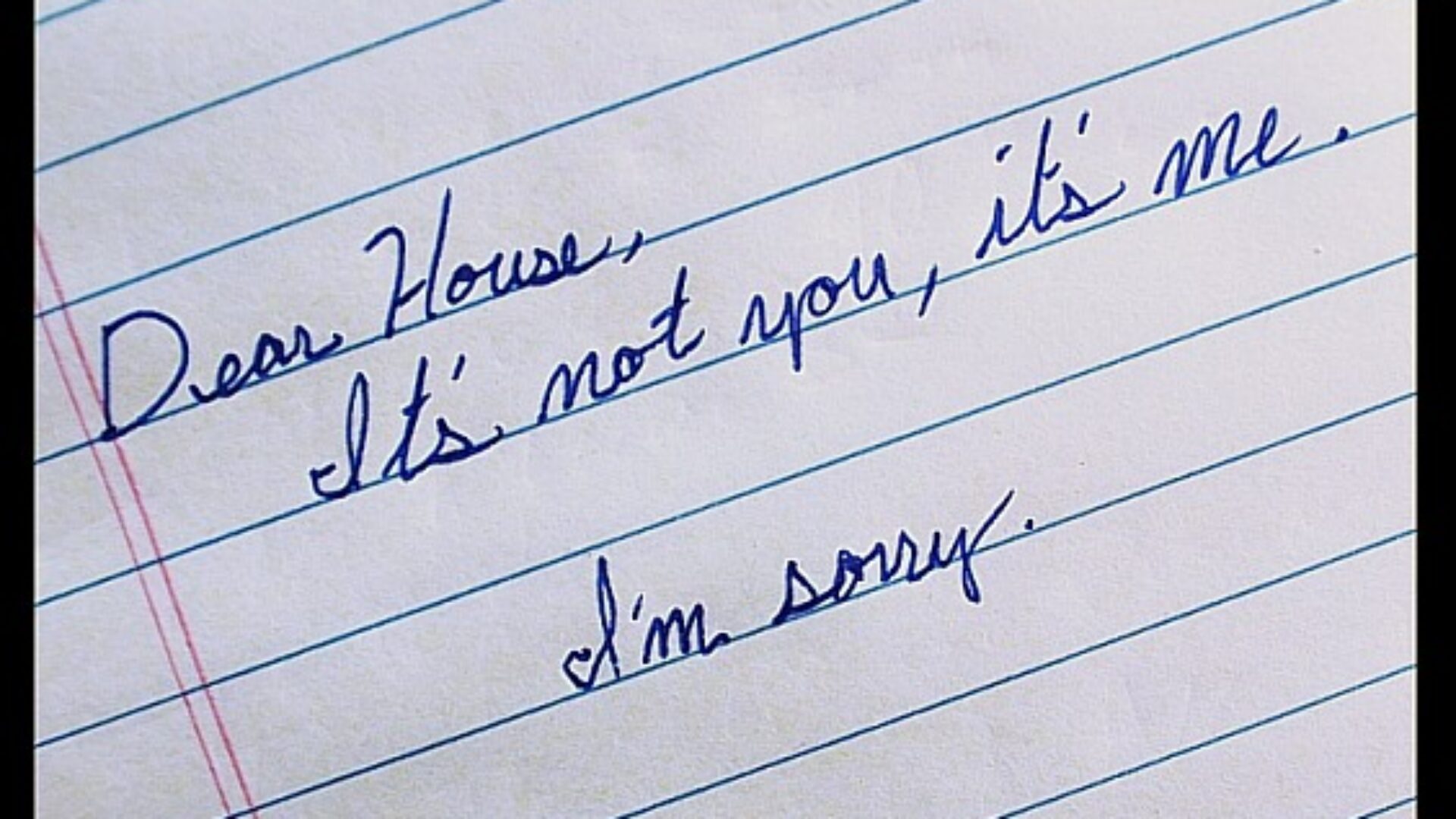

The list of possible reasons for an escrow falling apart is endless. The loss of an escrow after two or more weeks may be very disappointing to a seller.

There is also a significant loss of marketing momentum during the escrow period. And even if the issue or situation does not become a “deal-breaker”, the result almost always includes an increase in stress levels for all concerned!