As we have noted, nearly all market indicators appear to show that we began a transitioning phase by August, and that the market has quickly shifted from strongly favoring sellers to being roughly in balance between buyers and sellers as of October. This shift is largely due to the combination of a rapidly growing number of homes for sale and a reduction in sales per month.

The Pacific Palisades market today is quite different than it was near the last market peak at the end of 2007

That was just before the melt-down in the lending industry led to a marked decline in local home values averaging about 32% over 3 years. The data serves to provide some answers to these questions:

- How does the current rate of sales, average prices, and time it takes to sell compare with the market at the end of 2007? Are there any other notable differences?

- Since there seems to be far more leases done this year, how does the leasing market compare with the 2007 sales market which reached peak levels before adjusting significantly?

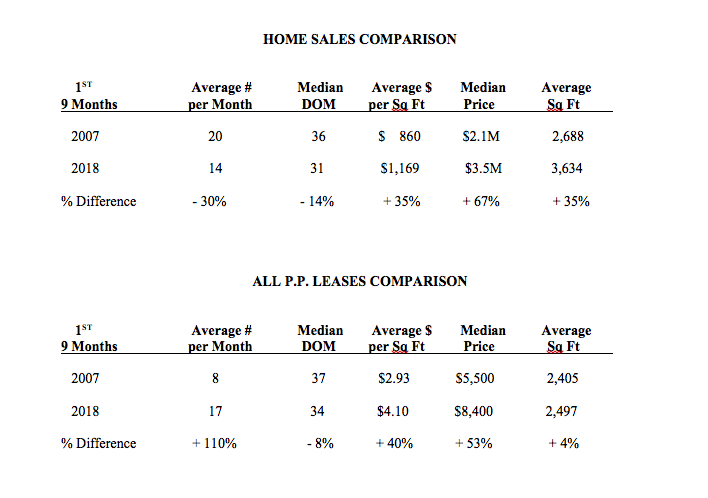

Similar to many other coastal communities, the Pacific Palisades market has been notably different than most of the country in average price movement. Whereas most of the country has only recently recovered from the significant price melt-down, owners in the Pacific Palisades have enjoyed a remarkable price increase averaging 35% above previous market high levels as measured in price per square foot.

A Market in Transition

Moreover, and primarily due to the substantially greater investor-driven factor, median prices are now 67% higher than they were at the end of 2007! The recent hot market environment led to a 14% reduction in the average time it takes to sell a Pacific Palisades home, as compared with 2007, reaching a historic low of only 31 days. One major indication of current market transitioning is that the average number of homes selling each month is now 30% lower than it was during the last market peak period.

In many respects, the local leasing market mirrors the sale market, with one very significant difference. The time it takes to lease is very comparable and is also shorter than at the last market peak period. However, the average number of leases being done is double that of 2007! Even more remarkably, the average number of leases done this year is greater than the rate of sales here, which is dramatically different than was the case in 2007.

It is interesting to note that the total average number of monthly leases and sales in 2007 was almost the same as in 2018. This may be a reflection that people who want or need to move each month is relatively unchanged in the Pacific Palisades from one market peak to the next. One factor that has led to this relative increase in leasing vs sales is reduced tax benefits of homeownership this year due to new tax regulations.

Also, contributing factors are the reduced affordability by an increasing number of prospective buyers due to average price appreciation rates averaging 5-12% per year, and far fewer homes available for purchase up to the last couple of months.

Leasing is Also on the Rise

There are also far more homes being leased than otherwise might have been sold 10 years ago because of family reluctance to sell with capital gains taxes due on huge increases in equity that have built up over the last several years. I have talked with dozens of local families over the last years who have decided to lease rather than sell because they were so opposed to paying any more taxes. Many of them are willing to forego the $250,000 – $500,000 exemption from capital gains taxes in order to convert their home into investment property which they later will sell using a tax-deferred exchange and purchase another property with the funds.

I was asked if it was easier to sell or to lease a home here, and if that has changed through the years. In reviewing all of the data for 2007 and 2018 sales and leases, I observed that approximately 70-75% succeeded whether selling or leasing. During the peak market periods, there are far fewer price adjustments, whether in leasing or sales. As the market transitions, the rate of price reductions accelerates until equilibrium is approached again near the market bottom.